Cultura y noticias hispanas del Valle del Hudson

Suplemento educativo

Applying for a Mortgage / Solicitar una hipoteca

Por Estela González Torres

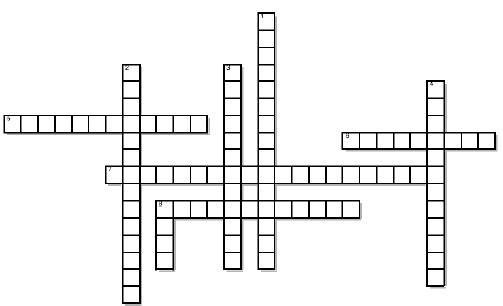

July 2016 Como la columna "Su dinero" de La Voz de junio estaba dedicada al préstamo hipotecario, en el suplemento educativo de este mes les pasamos vocabulario en inglés sobre el tema a través de un crucigrama para solicitar una hipoteca.

Son 9 conceptos (¡cuidado porque la mayoría están compuestos de dos o más palabras aunque en el crucigrama aparecen sin espacios!) que averiguará siguiendo la conversación que bien podría mantener usted (borrower) con su banco o prestamista (lender) para saber más sobre los términos de su hipoteca.

―Borrower (You): What would be the __________ __________ [4 DOWN] on my mortgage? I’d like to know more about the __________ __________ [9 ACROSS]: it’s the interest rate and fees, isn’t it?

―Lender (Your bank): Yes, that’s right. It also includes the APR or __________ __________ __________ [7 ACROSS], which accounts for the interest rate, points, fees and other charges you’ll pay for a mortgage.

―B: How can I calculate the __________ __________ [2 DOWN] that I’ll need to pay?

―L: We may charge you __________ __________[2 DOWN], origination points or both. One point is equal to 1 percent of the loan amount, that is, if you get a $155,000 mortgage and pay one discount point, you’ll pay a fee of $1,555.

―B: Alright, I see. And what about __________ __________ [5 ACROSS]?

―L: Borrowers need to pay fees at closing. Once we receive your loan application, we’ll provide a written estimate of these costs.

―B: Ok. What exactly is to __________ [8 DOWN] the interest rate? Will it cost me money?

―L: Interest rates might fluctuate between the time you apply for a mortgage and closing. You can lock the rate, and even the points, for a specified period to avoid a higger rate. Fees may apply, but not always.

―B: That’s good. Now I’d like to find out more about the __________ [3 DOWN] for this loan.

―L: Of course, here is a list. They are related to your income, employment, assets, liabilities and credit history.

―B: Great. I’ll take a look at them. Last but not least, what are the __________ [6 ACROSS] that I’ll need to show?

―L: We require proof of income and assets, including bank statements, tax returns, W-2 statements and recent pay stubs.

―B: That’s fine. Thank you very much. I think I’m ready to start my __________ __________ [1 DOWN].

―L: Great news. Please come back when it’s ready so we can start the process.

―B: Yes, I will. See you soon and thanks again.

ANSWER KEY:

ACROSS: 5. closing costs (gastos de cierre o escrituración) ; 6. documents (documentos); 7. annual percentage rate (tasa de interés anualizada -TIA- o porcentaje de interés anual); 8. loan estimate (estimación o cálculo del préstamo).

DOWN: 1. loan application (solicitud de préstamo); 2. discount points (puntos de descuento); 3. requirements (requisitos); 4. interest rate (tasa o tipo de interés); 8. lock (congelar).

COPYRIGHT 2016

La Voz, Cultura y noticias hispanas del Valle de Hudson

―Borrower (You): What would be the __________ __________ [4 DOWN] on my mortgage? I’d like to know more about the __________ __________ [9 ACROSS]: it’s the interest rate and fees, isn’t it?

―Lender (Your bank): Yes, that’s right. It also includes the APR or __________ __________ __________ [7 ACROSS], which accounts for the interest rate, points, fees and other charges you’ll pay for a mortgage.

―B: How can I calculate the __________ __________ [2 DOWN] that I’ll need to pay?

―L: We may charge you __________ __________[2 DOWN], origination points or both. One point is equal to 1 percent of the loan amount, that is, if you get a $155,000 mortgage and pay one discount point, you’ll pay a fee of $1,555.

―B: Alright, I see. And what about __________ __________ [5 ACROSS]?

―L: Borrowers need to pay fees at closing. Once we receive your loan application, we’ll provide a written estimate of these costs.

―B: Ok. What exactly is to __________ [8 DOWN] the interest rate? Will it cost me money?

―L: Interest rates might fluctuate between the time you apply for a mortgage and closing. You can lock the rate, and even the points, for a specified period to avoid a higger rate. Fees may apply, but not always.

―B: That’s good. Now I’d like to find out more about the __________ [3 DOWN] for this loan.

―L: Of course, here is a list. They are related to your income, employment, assets, liabilities and credit history.

―B: Great. I’ll take a look at them. Last but not least, what are the __________ [6 ACROSS] that I’ll need to show?

―L: We require proof of income and assets, including bank statements, tax returns, W-2 statements and recent pay stubs.

―B: That’s fine. Thank you very much. I think I’m ready to start my __________ __________ [1 DOWN].

―L: Great news. Please come back when it’s ready so we can start the process.

―B: Yes, I will. See you soon and thanks again.

ANSWER KEY:

ACROSS: 5. closing costs (gastos de cierre o escrituración) ; 6. documents (documentos); 7. annual percentage rate (tasa de interés anualizada -TIA- o porcentaje de interés anual); 8. loan estimate (estimación o cálculo del préstamo).

DOWN: 1. loan application (solicitud de préstamo); 2. discount points (puntos de descuento); 3. requirements (requisitos); 4. interest rate (tasa o tipo de interés); 8. lock (congelar).

COPYRIGHT 2016

La Voz, Cultura y noticias hispanas del Valle de Hudson

Comments | |

| Sorry, there are no comments at this time. |